Free Tax Preparation for Low- and Moderate-Income Households

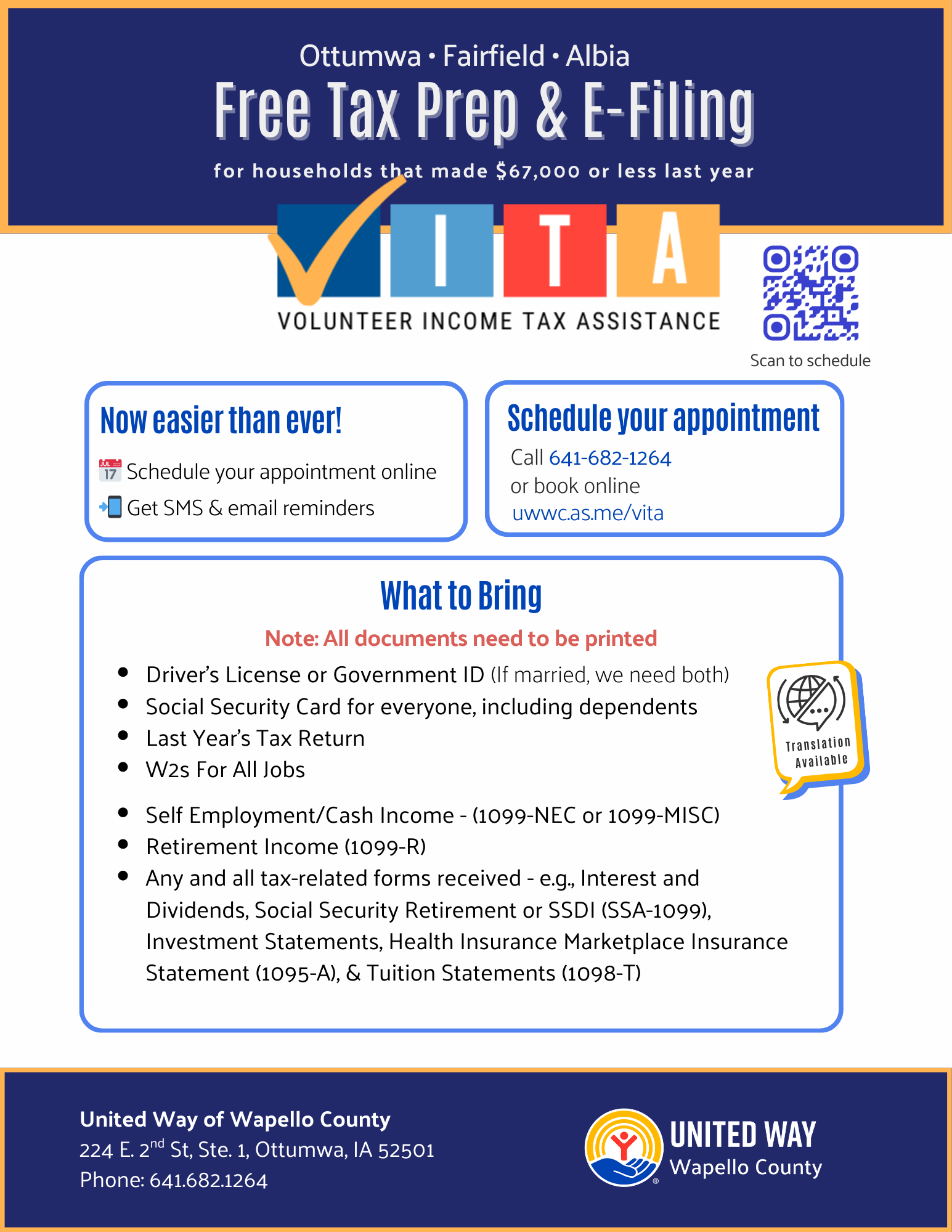

United Way of Wapello County offers free tax preparation through the IRS-supported Volunteer Income Tax Assistance (VITA) program.

Our trained and certified volunteers help ensure you receive all credits and deductions you are eligible for, including the Earned Income Tax Credit, Child Tax Credit, and more.

Who Can Receive Services?

VITA serves individuals and families who generally make $67,000 or less, as well as people with disabilities, seniors, and those who speak limited English, even if they surpass the $67,000 guideline.

vita Program FAQs

-

VITA is available to low- and moderate-income households ($67,000 in income in 2025), older adults, individuals with disabilities, veterans, and those facing language barriers.

-

Appointments & Walk-Ins

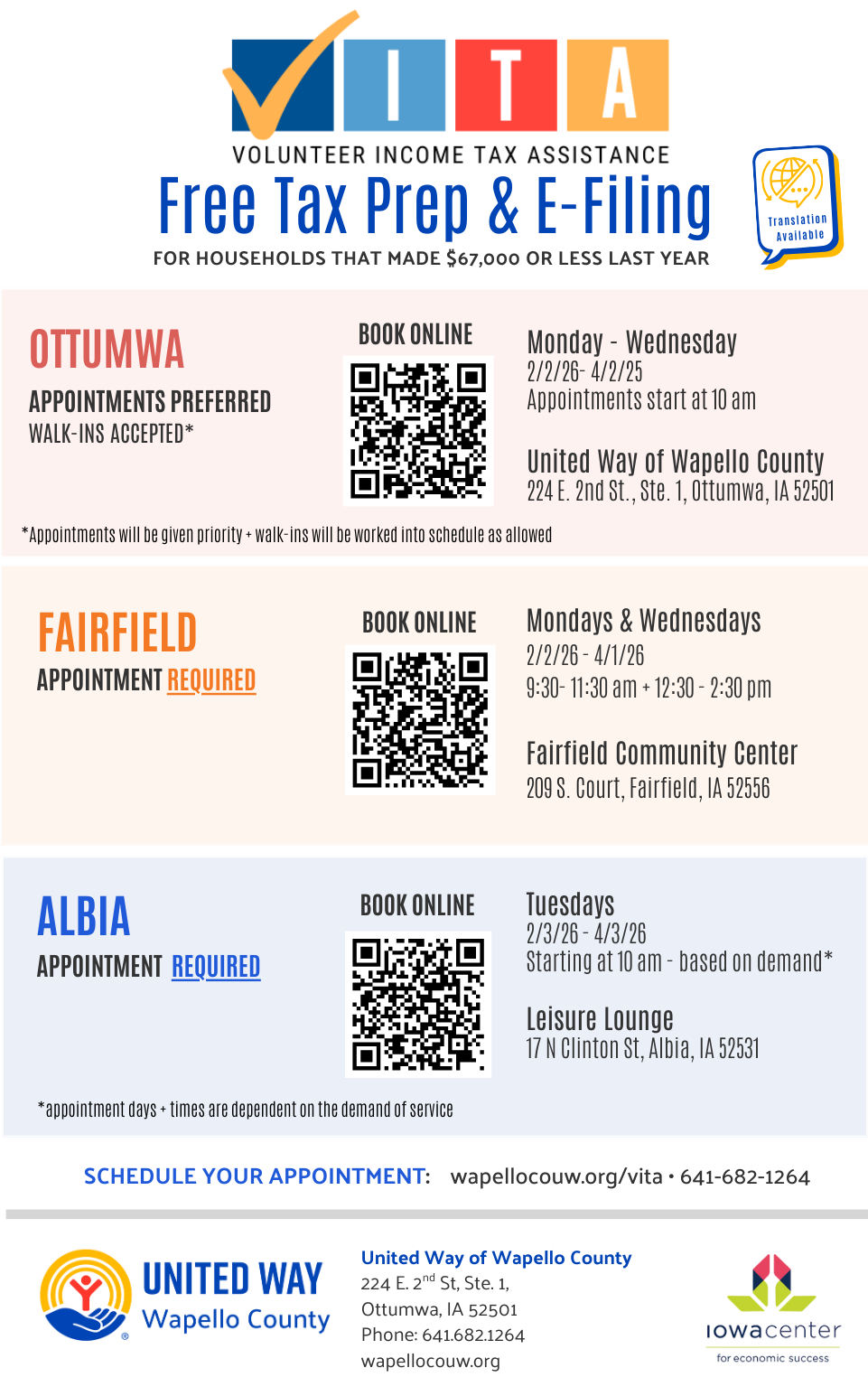

Appointments are strongly encouraged to ensure timely service.

Walk-ins are welcome at the Ottumwa location only. Walk-in clients will be assisted as availability allows, with scheduled appointments given priority.

-

VITA services are completely free. There is no charge to prepare or file your taxes.

-

Valid Photo ID (for both spouses if filing jointly)

Social Security Cards for all household members

Last year’s tax return (if available)

W-2s, 1099s, and all other income forms

Bank account & routing numbers for direct deposit

All forms must be printed (no digital copies, please)

Arrive 5–10 minutes early to complete a short yellow intake form

-

Yes, it is highly encouraged to bring a copy of the last year’s taxes you had filed to avoid possible complications.

-

Yes. We serve households in Wapello, Jefferson, and Monroe Counties, with VITA sites in Ottumwa, Fairfield, + Albia.

If you live outside of our service area, you can check the IRS’s VITA location site to find the location nearest you: https://freetaxassistance.for.irs.gov/s/sitelocator

-

Yes. All tax preparers are IRS-certified, and every return is reviewed for accuracy.

All VITA volunteers receive free training, and ongoing support is provided throughout the season.

-

Yes. All taxpayer information provided to VITA volunteers is handled securely and kept strictly confidential according to the IRS VITA program requirements.

IRS publications for VITA/TCE volunteers explicitly state that all tax information received in the volunteer role must remain confidential. I

-

Volunteer roles include tax preparation, client intake, scheduling, greeting clients, translation, and office support.

-

Yes. Phone interpretation is available through Linguistica International when needed.

In-person translation may be available through volunteers, depending on availability.Can I bring someone with me to help translate?

Yes. You are welcome and encouraged to bring a trusted person to your appointment to help with translation or communication support.

How do I request language support?

Please note your language needs when scheduling your appointment or let staff know when you arrive. This helps us prepare phone interpretation or volunteer support when possible.

tax return FAQs

-

Please bring all tax documents you received, including W-2s, 1099s, Social Security cards or ITIN letters for everyone on your return, and a photo ID. If you had health insurance through the Marketplace, you must bring your Form 1095-A.

-

Yes, it is highly encouraged to bring a copy of the last year’s taxes you had filed to avoid possible complications.

-

Most VITA returns are completed within 14 days of drop-off. We will contact you when your return is ready to review and sign.

-

Yes. Language assistance may be available by phone or in person. Please let us know when scheduling or at intake if you need language support.

-

Some overtime pay may qualify for a tax deduction. Only the overtime portion above your regular pay rate may be eligible. Additional documentation may be required.

-

Yes. Tips reported by your employer are included on your W-2 and must be reported. The tax treatment of tips depends on how they were reported.

-

Only interest on certain new vehicles may qualify, and strict rules apply. Used vehicles and principal payments do not qualify.

-

Energy credits require specific manufacturer product codes. Receipts without required codes may not qualify.

-

Dependency rules are based on relationship, residency, support, and filing status. Our volunteers will review your situation to determine eligibility.

-

Education credits depend on enrollment status, prior years of education, scholarships, and whether the student is claimed as a dependent.

Book your free tax appointment

United Way of Wapello County offers free, IRS-certified tax preparation and filing through our Volunteer Income Tax Assistance (VITA) program.

Use the scheduling tool to book an appointment at the location and time that works best for you.

Appointments are strongly encouraged to reduce wait times and ensure faster service.

Walk-ins are accepted at our Ottumwa location only, as availability allows.

Need Help Scheduling?

If you have questions or need assistance booking an appointment, call us at 641-682-1264.